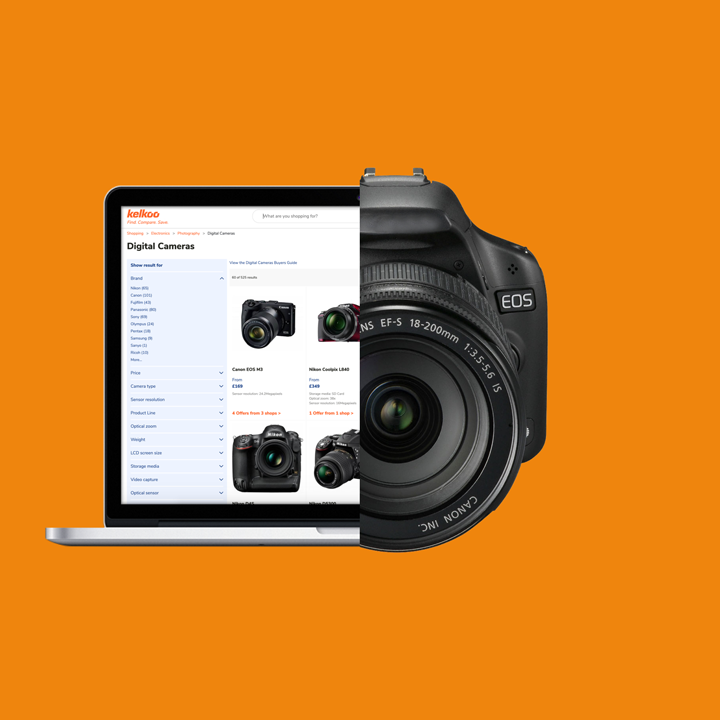

The power of Kelkoo Group

- 39

Countries

Global presence

- 10K

Merchants

Trust Kelkoo Group

- 350M

Clicks

Generated annually

Case studies

With 20 years of experience in e-commerce, digital advertising and consumer analytics, we are trusted all over the world by merchants, publishers, agencies and e-shoppers for the quality and performance of our services

Gain the latest insights

with our e-commerce guides

Looking to learn how to monetise your website and drive e-commerce sales?

In our Kelkoo Group Guides we share top tips for both merchants and publishers.